After more than three years of personally using XM, I can confidently say it’s one of the most reliable forex brokers I’ve ever traded with. I’ve tried a variety of platforms in the past, but XM continues to stand out for many good reasons—easy withdrawals, responsive support, and a ton of free educational resources including webinars and even live seminars in select countries.

Whether you’re a beginner or a more experienced trader like me, XM offers the tools and support to help you grow.

If you’re currently searching for a dependable forex broker, chances are you’ve come across XM. With millions of traders across the globe and over a decade of experience in the trading industry, XM has built a solid reputation in the world of online forex and CFD trading. But is it the right broker for your trading goals?

In this in-depth XM broker review, I’ll walk you through everything you need to know—from regulations and account types to trading platforms, fees, support, and my personal experience—so you can decide if XM is a good fit for you.

Overview of XM

Before diving into the specifics, let’s take a closer look at who XM is and why they’ve become a go-to broker for many traders.

XM is a globally recognized forex and CFD broker, launched in 2009 under Trading Point Holdings. With more than 5 million clients across 190+ countries, XM offers a wide range of instruments including forex, stocks, commodities, indices, and cryptocurrencies.

What makes XM stand out is their accessible trading environment, low starting deposit, and dedication to trader education. These qualities make it suitable for both beginners and experienced traders.

Is XM Regulated?

Regulation is one of the first things I look at when choosing a broker. With XM, you get peace of mind knowing they’re fully regulated by respected financial authorities:

- CySEC (Cyprus Securities and Exchange Commission)

- ASIC (Australian Securities and Investments Commission)

- FSC (Financial Services Commission in Belize)

These licenses mean XM adheres to strict standards around fund security, client protection, and operational transparency.

XM Account Types

One of the things I really like about XM is the variety of account types they offer. Whether you’re brand new or a seasoned trader, there’s something to match your style:

- Micro Account

- 1 lot = 1,000 units

- Ideal for beginners and those starting with small capital

- Great for practicing with minimal risk

- Standard Account

- 1 lot = 100,000 units

- Suitable for intermediate traders

- No commission and competitive spreads

- Ultra Low Account

- Lower spreads (starting from 0.6 pips)

- No extra commissions

- Best for active or cost-conscious traders

- Shares Account

- Trade real stocks (no leverage)

- USD-based only

- Designed for investors who prefer buying and holding actual shares

All accounts include features like leverage up to 1:1000 (depending on region), negative balance protection, and full access to XM’s platforms.

Trading Platforms

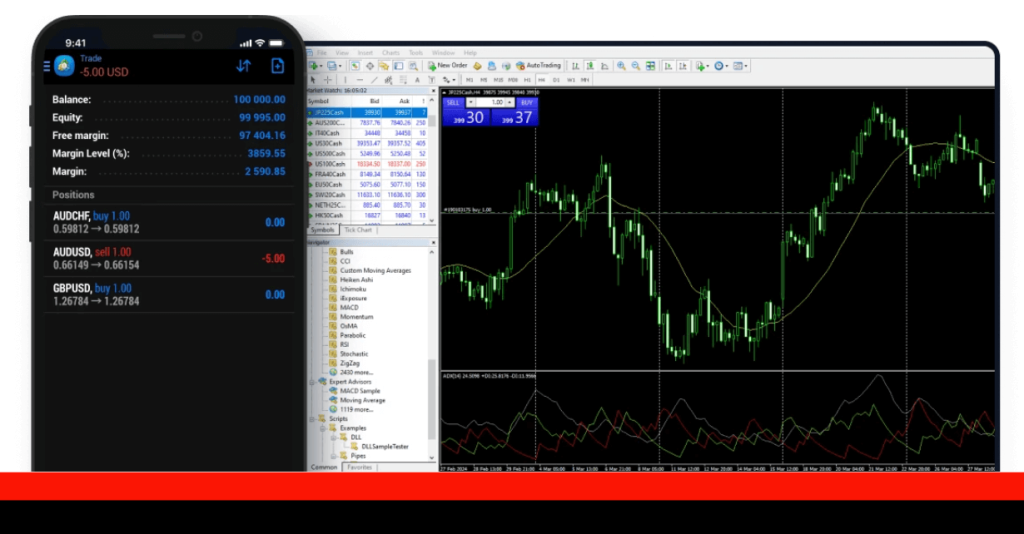

A good trading platform can make your experience smoother and more efficient. XM supports multiple platforms, all designed for different needs:

- MetaTrader 4 (MT4): This classic platform is fast, reliable, and packed with features for forex traders.

- MetaTrader 5 (MT5): More advanced than MT4, offering additional tools, markets, and order types.

On top of that, XM offers:

- XM Mobile App: Perfect for trading on the go. I personally use this to monitor and manage my trades when I’m away from the desk.

- WebTrader: A browser-based version that lets you trade directly online—no download needed.

Having these flexible options really helps, especially when you’re moving between devices.

Spreads, Fees & Commissions

Let’s talk costs. XM keeps their pricing model simple and competitive:

- Spreads: As low as 0.6 pips on Ultra Low accounts

- Commission: None on most account types

- Swap Fees: Charged on overnight positions

- Inactivity Fee: $5/month after 90 days of no trading activity

In my experience, these fees are very reasonable compared to other brokers. Just stay active to avoid the inactivity charge.

Deposit & Withdrawal Methods

This is where XM shines. Deposits are quick, and withdrawals are typically processed within 24 hours. I’ve never had issues withdrawing profits, which says a lot.

Available methods include:

- Bank Transfer

- Credit/Debit Cards

- Skrill, Neteller, and other e-wallets

- Local payment methods (varies by region)

There are also no hidden fees from XM’s end, which is always a plus.

Customer Support

XM’s customer service is responsive and easy to reach. They offer:

- 24/5 Live Chat

- Email and phone support

- Multilingual service

They also provide ongoing education like webinars, tutorials, and daily market updates. I’ve attended some of their webinars myself and found them incredibly helpful.

Pros and Cons

Here’s a quick summary of XM’s strengths and areas to consider:

Pros:

- Regulated by multiple authorities

- Low entry barrier ($5 minimum deposit)

- Commission-free accounts

- Excellent mobile and web platforms

- Abundant free education and analysis

Cons:

- No ECN account

- Limited crypto options

- Support unavailable on weekends

Who Should Use XM?

Based on my experience, XM is ideal for:

- Beginners who want a safe, low-cost start

- Intermediate traders looking for dependable service and tools

- Manual or copy traders using MT4/MT5

- Anyone who values strong educational support and ease of use

If you’re a scalper or high-frequency trader needing ECN conditions, you might want to look at alternatives. But for most retail traders, XM is more than capable.

Frequently Asked Questions

Is XM safe to trade with? Yes, they’re regulated by top-tier bodies and have a long-standing reputation.

What is the minimum deposit? Just $5 for Micro and Standard accounts.

Does XM offer copy trading? Not directly, but you can integrate third-party copy trading tools with MT4/MT5.

Is XM available in the Philippines? Absolutely, and they even support local deposit channels.

Final Verdict

After years of using XM, I can confidently say it’s one of the best brokers I’ve ever worked with. They’ve earned my trust with their smooth withdrawals, strong platform options, and commitment to trader education.

Their free webinars, tutorials, and market insights helped me improve my trading significantly over time. Whether you’re just starting out or have been trading for a while, XM offers a solid foundation with everything you need to grow.

If you’re thinking of joining, I suggest starting with a demo account or a small live account to get a feel for the platform.

Happy trading!