Forex trading is becoming a hot topic in the Philippines, as more and more people are searching for ways to grow their money online. With global markets open 24 hours a day, five days a week, forex trading gives Filipinos a chance to participate in the same financial opportunities that traders around the world enjoy.

If you’ve ever exchanged pesos for dollars at a money changer, you’ve already done a form of forex trading. The online version just happens on a much bigger scale, with over $7 trillion traded daily. This article will guide you step-by-step into the world of what is forex trading in the Philippines — what it is, how it works, whether it’s legal, and how to start safely.

What is Forex Trading?

Before you risk a single peso, it’s important to understand what forex trading really means. Forex, short for “foreign exchange,” is the process of buying one currency while selling another. Currencies are always traded in pairs — like USD/PHP or EUR/USD — and the goal is to profit from changes in their value.

For example, if you expect the peso to weaken against the dollar, you can buy USD/PHP. If the rate moves in your favor, you make a profit. This market is attractive because it is highly liquid, operates 24/5, and offers opportunities whether prices go up or down. Learn more at Investopedia.

Is Forex Trading Legal in the Philippines?

One of the first concerns beginners ask is: “Am I allowed to trade forex in the Philippines?” The answer is yes — forex trading is legal. However, regulation is a little different compared to stock trading. More details here: is forex trading legal in the Philippines.

The Bangko Sentral ng Pilipinas (BSP) supervises foreign exchange dealers and banks, but most retail forex brokers are based overseas. Filipinos are free to open accounts with these brokers, provided the brokers are regulated in their own jurisdictions (for example, CySEC in Europe, ASIC in Australia, FCA in the UK).

This means you don’t need special permission to trade, but you must be smart when choosing a broker to avoid scams. Always prioritize regulation and reputation.

Why Filipinos are Getting Into Forex Trading

Filipinos have unique reasons for joining the forex market. For many, it’s the promise of earning in dollars while living in the Philippines. With the peso’s value fluctuating, the chance to profit from forex movements can be appealing.

Others are drawn by the flexibility. Unlike businesses that require a physical location, forex trading only needs a smartphone, internet, and knowledge. Some Filipinos see it as a side hustle alongside their jobs, while others aim to turn it into a full-time career. The low capital requirement compared to businesses like franchising or traditional investments also makes it more attractive to beginners.

How to Start Forex Trading in the Philippines

If you’re curious about forex but don’t know where to begin, here’s a clear roadmap. Think of this as your step-by-step starting guide:

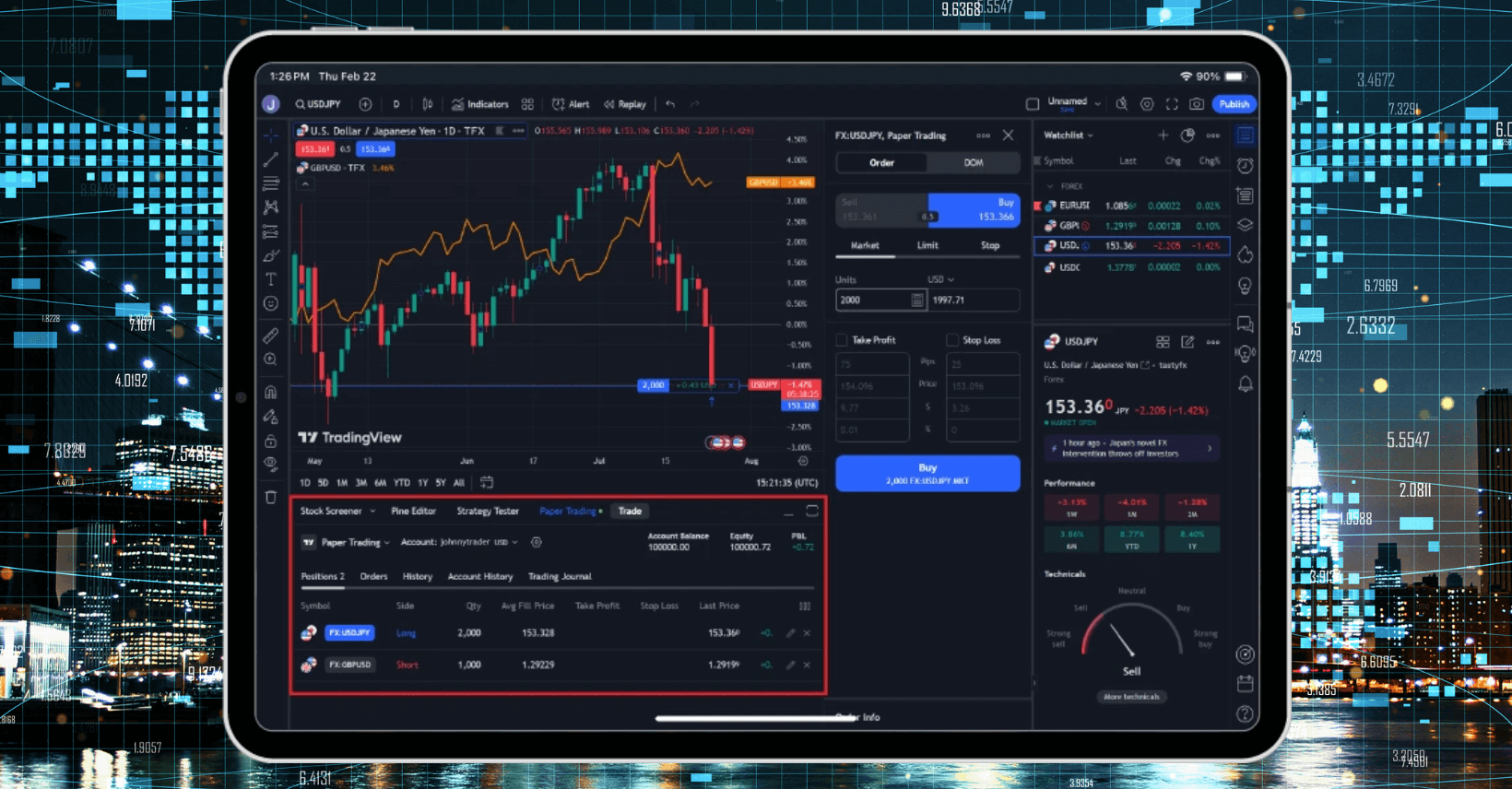

- Choose a Reliable Forex Broker – The first and most important step is selecting the right broker. This is the company that provides you access to the forex market. Look for brokers that are regulated, accept Philippine clients, and offer platforms like MT4, MT5, or TradingView. One popular choice among Filipino traders is XM.

- Open and Verify Your Account – Once you choose a broker, you’ll need to open an account. The process is similar to opening a bank account — you’ll submit personal information and upload documents like a valid government ID and proof of address.

- Fund Your Account – To start trading, you’ll deposit funds into your account. Many brokers that serve Filipinos accept local methods like GCash, PayMaya, BPI, BDO, UnionBank, and debit or credit cards. Minimum deposits usually range between $5 to $100 (₱285 – ₱5,700).

- Download a Trading Platform – The trading platform is your main tool. It’s where you’ll analyze charts, open trades, and manage risk. Popular choices include MetaTrader 4, MetaTrader 5, and mobile apps.

- Start with a Demo Account – A demo account allows you to trade with virtual money. This is your training ground, where you’ll learn how forex works without risking real money.

How Much Capital Do You Need to Start?

This is the million-peso question for many Filipinos. Technically, you can start trading with as little as ₱5,000, but your experience will be very limited. Let’s break it down using today’s exchange rate ($1 = ₱57.22):

- ₱5,000 (~$87) – You can trade micro lots, but your profit potential will be small. Great for practice.

- ₱10,000 (~$175) – Gives you more room for strategy testing with slightly larger trades.

- ₱50,000 (~$875) – Ideal for those serious about forex, as it allows better risk management and meaningful returns.

The key is to never trade with money you can’t afford to lose. Start small, focus on building skill, then scale up.

Forex Trading Strategies for Beginners

There’s no one-size-fits-all strategy in forex. Traders use different styles depending on their goals, time availability, and personality:

- Scalping – Dozens of quick trades per day, aiming for small profits.

- Day Trading – Opening and closing trades within a day. No overnight risk.

- Swing Trading – Holding trades for days or weeks, riding medium-term trends.

- Position Trading – Long-term trading, holding positions for months.

Beginners should try different strategies on demo first before committing real money. A good primer is available at DailyForex.

Risks and Challenges of Forex Trading

While forex can be profitable, it’s not without risks. Many beginners lose money because they jump in unprepared. Common challenges include:

- High leverage risk – Borrowing too much trading power can wipe out accounts quickly.

- Unregulated brokers – Some lure beginners with promises of high returns but are scams.

- Emotions – Greed and fear often ruin trading decisions.

- Internet issues – In the Philippines, unstable internet can interrupt trades.

Understanding these risks is the first step to managing them.

Tips for Success in Forex Trading

- Always use a stop-loss to limit losses.

- Risk only 1–2% of your capital per trade.

- Keep a trading journal to review your mistakes and successes.

- Stay updated on economic news that affects currency prices.

- Focus on learning first — profits come later.

Best Forex Brokers for Filipinos (2025)

Choosing the right broker can make or break your trading journey. Here are some trusted names that work well for Filipinos:

- XM – Known for low spreads, fast execution, and a $30 no-deposit bonus.

- Exness – Offers flexible leverage and easy local deposits.

- LiteFinance – Great for scalpers and advanced traders.

- Vantage Markets – Beginner-friendly with simple apps and promotions.

Always confirm regulation before depositing, and start with a small amount to test withdrawals.

Taxes and Compliance in the Philippines

Many beginners overlook the tax side of forex. In the Philippines, forex earnings are considered taxable income. While enforcement is still developing, the Bureau of Internal Revenue (BIR) expects traders to declare their income. It’s best to consult a tax professional to stay compliant and avoid future issues.

FAQs About Forex Trading in the Philippines

1. Is forex trading legal in the Philippines?

Yes. Filipinos can legally trade forex through regulated international brokers.

2. How much do I need to start forex trading?

You can start with as little as ₱5,000, but ₱10,000–₱50,000 gives a better experience.

3. Can I trade forex using my phone?

Yes. Almost all brokers offer mobile apps for iOS and Android.

4. Do I need a license to trade forex in the Philippines?

No license is required for individuals. Only brokers need to be regulated.

Conclusion

Forex trading in the Philippines is a growing opportunity for those willing to learn the ropes and practice discipline. It’s not a shortcut to wealth, but with the right mindset and strategy, it can become a valuable skill and source of income.

The journey begins with education, practice on a demo account, and eventually trading with small amounts of real money. Over time, consistent learning and risk management will set you apart from the majority of traders who quit too soon.

🚀 Are you ready to start your forex journey? Open a demo account today with a trusted broker and take your first step toward financial independence through forex trading in the Philippines.